BLOG

From buying your first home to tackling debt.

Prep Now, Stress Less: 4 Essentials to Build a Financial Emergency Kit

Life can be unpredictable. Start now and build a financial emergency kit.

Drive Toward Financial Wellness: Certified Pre-Owned vs. New Cars

If you’re in the market for a car, one of the biggest questions is whether to buy new or go for a certified pre-owned vehicle.

Peake Federal Credit Union Supports a Healthier Financial Future

Celebrate August as National Wellness Month and focus on the benefits of your financial health.

Credit Reports: Fraud Alert vs. Security Freeze

When it comes to protecting your credit, you may have heard terms like “fraud alert” and “security freeze.” Both are tools you can use to guard your personal information, but they work in different ways.

Tips for Preventing Check Fraud

Check fraud is one of the largest challenges facing businesses and financial institutions today.

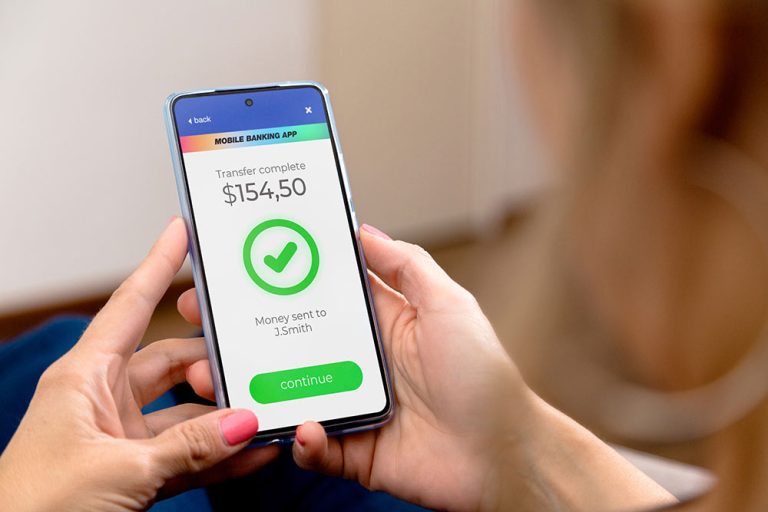

Person-to Person Money Transfers 101

Many people enjoy the convenience of using person-to-person money transfers such as Apple Pay®, Cash App, Google Pay®, Venmo, and PayPal.

First-Time Home Buyers 101

Home ownership brings intangible benefits, such as a sense of stability and pride of ownership, along with the tangible ones of tax deductions and equity.

Get Inspired During Financial Education Awareness Month

April is National Financial Education Month, a time to recognize the value of financial education and identify ways to improve our money management.

Cheers to 60 years…Looking Back at Peake Federal’s Anniversary Year Celebration

January 15, 2023, marked a milestone anniversary for the Peake Federal Credit Union—60 years of serving members!

An ARM or Fixed-Rate Mortgage – Which is right for you?

Choosing between an adjustable and fixed-rate mortgage is a matter of knowing your options and weighing the benefits against the downsides of each

Mobile Wallets– A Fast, Easy & Secure Way To Pay!

Did you know you can use your smartphone as a mobile wallet? Google-Pay®, Apple Pay®, and Samsung Pay®.

Fight Fraud with Account Alerts

The Federal Trade Commission has designated March 5 through March 11 as National Consumer Protection week.